We’ve finally made it to 2022, and it seems like the cryptocurrency trend is here to stay this year (not unlike COVID-19).

Cryptocurrencies’ ubiquity is not just limited to news headlines. It looks set to seep into our daily life as well, now that PayPal, Venmo (the American version of PayNow) and Tesla have begun accepting payments in Bitcoin (BTC). It’s only a matter of time before other tech companies start doing the same.

So if you want to buy yourself some crypto before it gets all mainstream, here’s a guide to comparing the different crypto exchanges out there and choosing the best one.

Before you open a crypto exchange account, read this first!

Don’t know your BTC from ETH? Easy tiger — you’ll want to read up on the basics of cryptocurrency first. We’ve put together a simple guide for you: Cryptocurrency in Singapore: 7 Things to Know Before You Start Buying.

This primer will tell you 7 super important things you should know about crypto before you buy it, including:

- What the world of cryptocurrencies is like

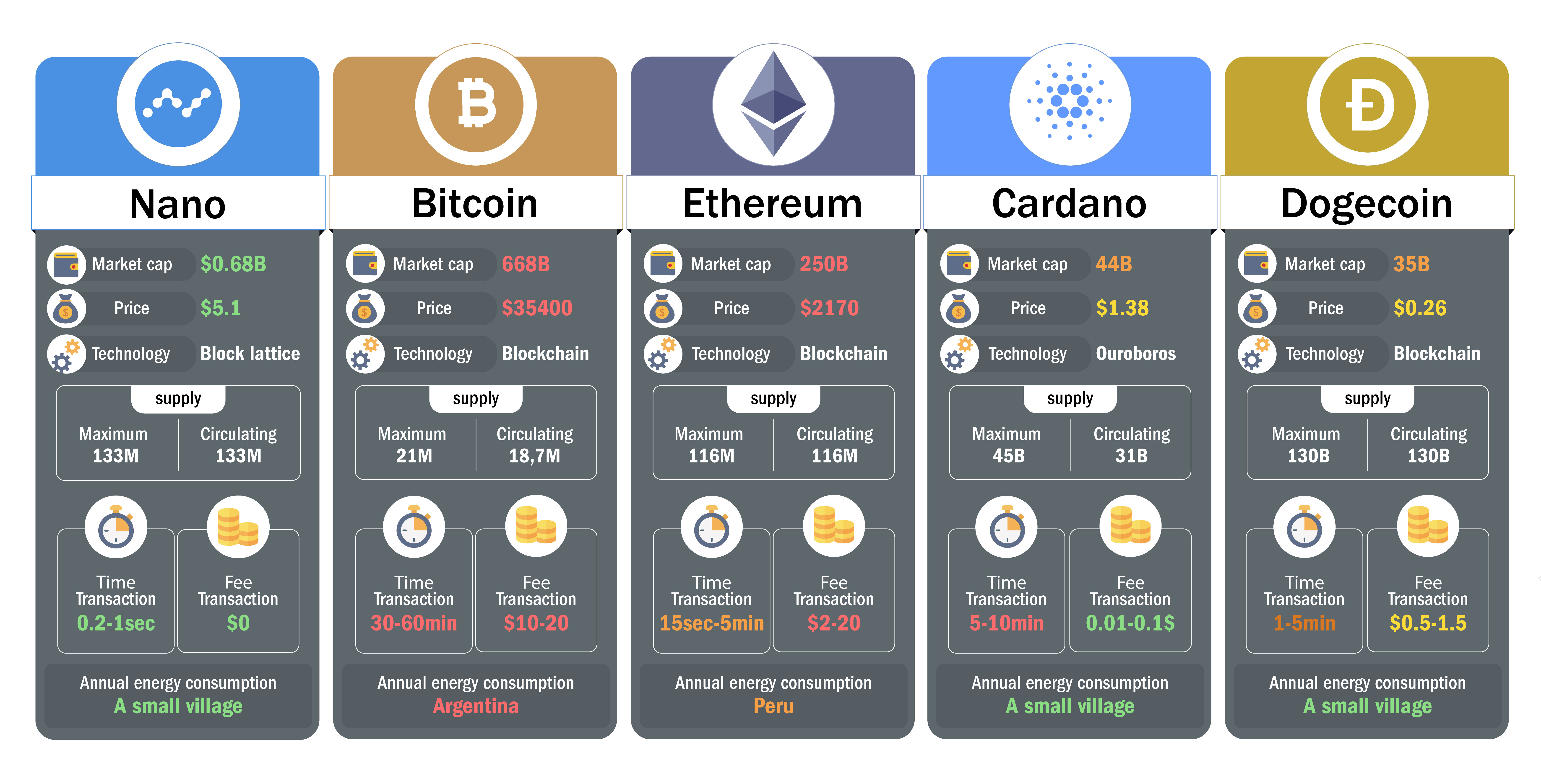

- What are the top cryptocurrencies

- Why cryptocurrencies are the way they are

- How much cryptocurrencies’ fluctuate in value

- How to store your cryptocurrency

- What to look out for in a cryptocurrency’s whitepaper

- How to buy/trade cryptocurrency sensibly

When you’re done reading that, you’ll be informed of the risks involved in buying cryptocurrencies.

If you do decide to dip your toes into the crypto ocean (deep waters alert!), here’s how you can choose a cryptocurrency exchange platform and get your hands on some coin.

Which are the best crypto exchanges in Singapore?

There are tons of cryptocurrency trading platforms out there, but we’ve shortlisted 10 of the most popular ones.

| Cryptocurrency exchange | Number of listed cryptocurrencies | Trading Fees | BTC and ETH purchasable with SGD? |

| Bitmex | 20 | 0.05% | No |

| OKEx | 333 | 0.1% | Yes |

| Bitfinex | 172 | 0.2% | No |

| Huobi Global | 409 | 0.2% | Yes |

| Crypto.com | 169 | 0.4% | Yes |

| Kraken | 99 | 0.26% | No |

| Gemini | 70 | 0.35% | Yes |

| Coinbase | 151 | 0.5% to 2.5% | Yes |

| Independent Reserve | 27 | 0.5% | Yes |

| Zipmex | 107 | 0.2% | Yes |

The table above reflects the trading fees across 10 crypto exchanges but that’s not all you have to consider before signing up for an account.

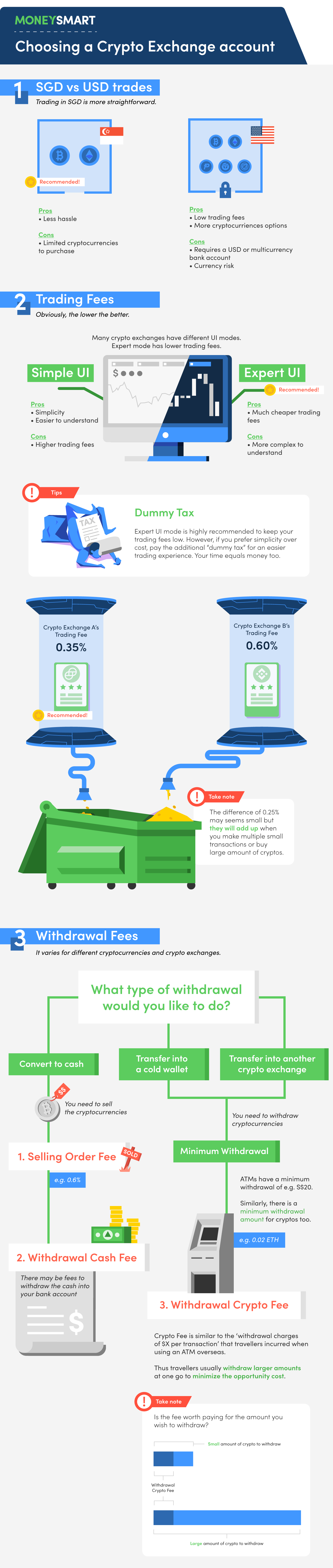

There are lots of factors that go into choosing the best cryptocurrency exchange, but it can be boiled down to the following:

- Ability to transact in Singapore Dollars

- Transaction fees + difference in pricing for user interface options

- If there are any withdrawal fees, and how much

- Trading fees according to maximum yearly limit of S$30,000, as per stipulated by MAS

We’ll run through these 3 factors in detail below.

1. Does the crypto exchange support SGD?

Not all crypto exchanges allow you to buy major cryptocurrencies in Singapore Dollars. Here are the ones that do support SGD, at least for Bitcoin and Ethereum:

| Cryptocurrency exchange | Number of listed cryptocurrencies | Trading Fees | BTC and ETH purchasable with SGD? |

| Crypto.com | 169 | 0.4% | Yes |

| Gemini | 70 | 0.35% to 1.49% | Yes |

| OKEx | 333 | 0.1% | Yes |

| Coinbase | 151 | 0.5% to 4.5% | Yes |

| Huobi Global | 409 | 0.2% | Yes |

| Independent Reserve | 27 | 0.5% | Yes |

| Zipmex | 107 | 0.2% | Yes |

What we noticed is that some crypto exchanges feature very low trading fees, but they only applicable for USD trades, with the use of their proprietary USD wallet. This implies that you’ll most likely need to have a USD bank account, or at the very least, a multi-currency bank account.

So if you pick a crypto exchange that supports SGD, it’s less hassle.

FYI, we only included BTC and ETH here as the smaller cryptos tend not to support SGD. To buy those, you’d typically buy BTC first, then exchange your BTC to your crypto of choice. Also, the above mentioned trading fees are with the maximum yearly transaction volume of S$30,000, as per stipulated by MAS.

2. What’s the crypto exchange’s fee structure?

It’s common for crypto exchanges to offer at least two user interfaces: simple mode (for everyone) and expert mode (more technical and aimed at seasoned traders).

But… did you know that some crypto exchanges actually charge more when you use the simple version?! Here’s a look at the different trading fees depending on the UI you pick.

Cryptocurrency exchange | Trading Fees (Simple UI) | Trading Fees (Expert UI) |

| Coinbase | 2.49%++ | 0.50% |

| Kraken | 1.5%++ | 0.26% |

| Gemini | 1.49%++ | 0.35% |

| Crypto.com | 3.5%++ | 0.4% |

| Bitfinex | Not applicable | 0.2% |

| Huobi Global | Not applicable | 0.2% |

| Bitmex | Not applicable | 0.05% |

| Okex | Not applicable | 0.1% |

| eToro | Not applicable | Spread |

| Zipmex | Not applicable | 0.20% |

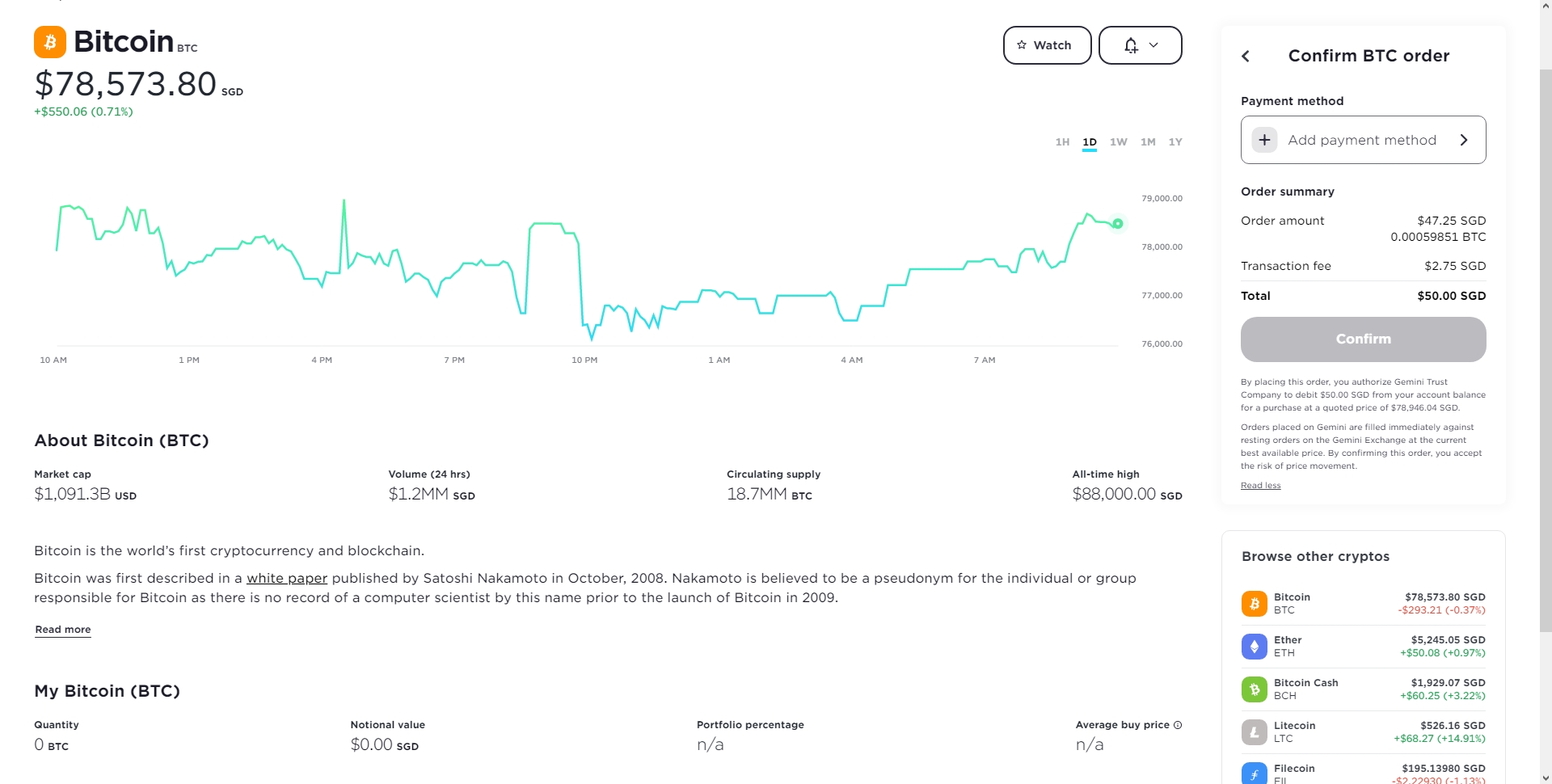

Here’s an example: Gemini. When you first sign up, and you want to make your crypto purchase, you would be greeted with this nice, simple UI.

To unlock Gemini’s cheaper 0.35% transaction fees, you need to use Gemini‘s expert-level ActiveTrader UI, which looks like this. For simplicity’s sake, I’ve bought BTC by using a limit order — the closest thing you can use to “buy” cryptocurrency upfront with the ActiveTrader UI. Here, you’ll only pay S$0.17. If we look to the right, purchasing BTC for S$50 incurs a transaction fee of S$2.75 if we stick to the simple UI. Oh, you’ll pay for that simplicity. That’s a whopping 5.5% in transaction fees!

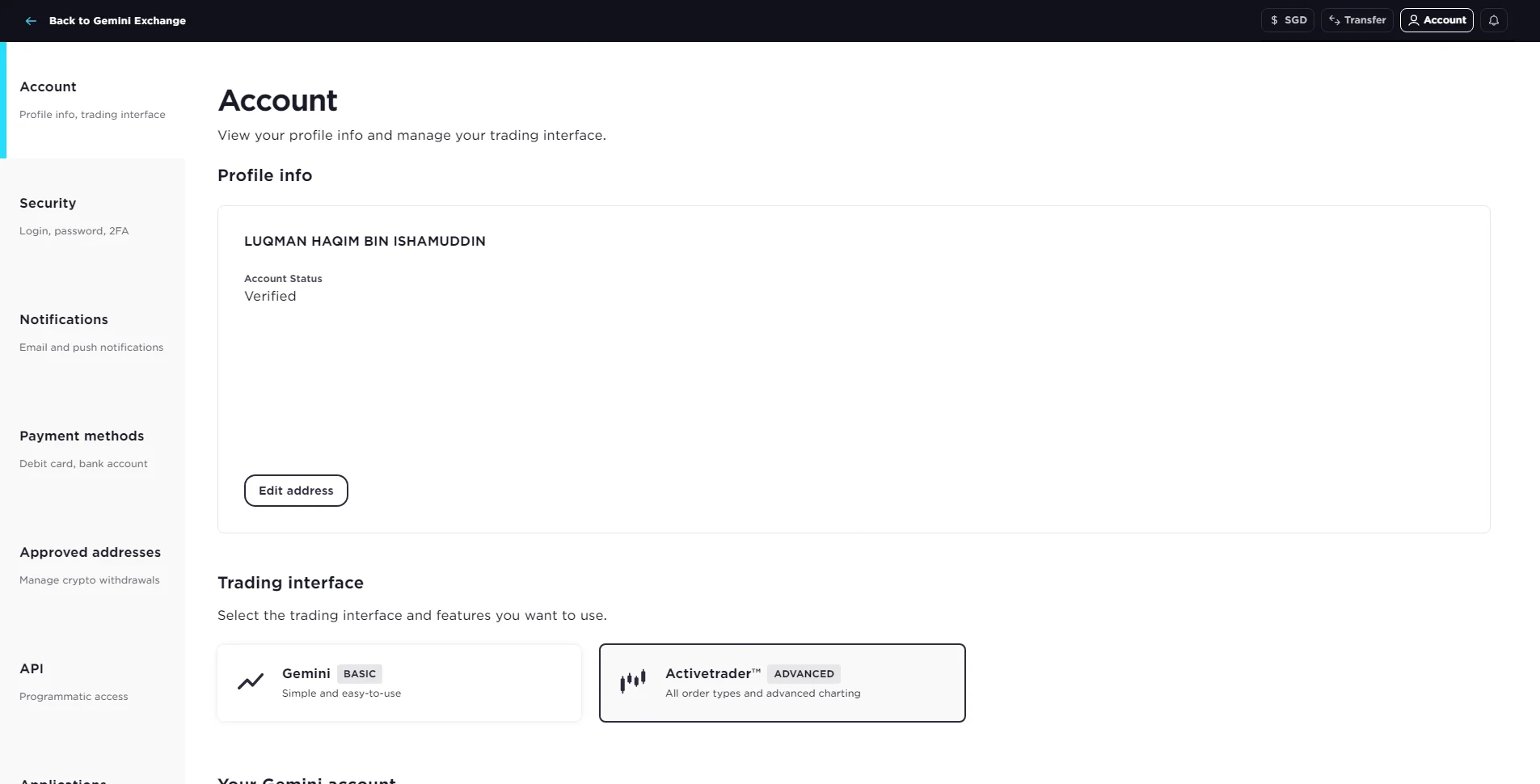

It’s definitely worth tinkering around in the settings to make the switch to the expert UI for more savings. Go to Account, then select the ActiveTrader option under Trading Interface:

2a. What if you want to stick to the simple UI?

If you can’t deal with the expert UI, then you’ll have to pay the dummy tax. You can use our crypto exchange summary table to see if it’s charging a reasonable fee.

BUT, if you are not concerned about pretty interfaces, then opting for Gemini‘s ActiveTrader will give you a much better deal. These fees add up if you keep buying small amounts frequently, and/or buy large amounts of crypto (not recommended for the faint-hearted).

3. How much does the crypto exchange charge for withdrawal?

We’ve covered the fees for buying crypto on an exchange above. But what about withdrawing your cryptocurrency at some point? Prepare to upgrade your headache into a raging migraine.

Most cryptocurrency exchanges have their own withdrawal fee structure, and in a perfect world, everything would be simple and intuitive.

Here are a few guidelines to keep in mind when making withdrawals on any cryptocurrency exchanges:

- Do I want to withdraw my cryptocurrency into cash?

- This is a selling order — what are the fees for the selling order?

- After completing the selling order, is there a fee to withdraw it into my bank account?

- Do I want to withdraw my cryptocurrency into a cold wallet or a different crypto exchange?

- What are the fees to withdraw cryptocurrencies?

- What are the minimum withdrawal amounts?

- Is the fee worth paying for the amount you wish to withdraw?

The last point is especially important.

For example, some exchanges like Zipmex even charge you for withdrawing SGD — 0.3% of whatever you withdraw. Be sure to check!

Make sure you keep this in mind if you want to store your cryptocurrency into a cold wallet!

4. Crypto exchanges in Singapore with official licenses issued by MAS under the Payment Services Act

Most crypto exchanges in Singapore are operating under exemptions whilst MAS transitions to a formalised, licensing framework under the Payment Services Act.

The only two officially licensed crypto exchanges in Singapore are as of 13 December 2021 are:

- DBS Vickers

- Independent Reserve

Our picks for the best crypto exchanges in Singapore

The best crypto exchange currently is Gemini, if you’re looking to optimise trading your crypto with relatively low fees, simple-to-grasp expert UI and ease of purchase with Singapore dollars.

That being said, it bears repeating that the crypto market is still fairly unregulated in Singapore, and that Senior Minister Tharman Shanmugaratnam said about this crypto in Parliament:

“Cryptocurrencies can be highly volatile, as their value is typically not related to any economic fundamentals. They are hence highly risky as investment products, and certainly not suitable for retail investors.”

Regardless of your appetite for risk, we definitely don’t recommend investing your life savings in crypto. Be sure to balance it out with safer, more established investments like stocks and ETFs. Read our guide on how to start investing in Singapore, as well as tons of other, more advanced guides to get ahead.

![[Trezor One] Trezor One Hardware Wallet](/web/image/product.template/49132/image_512/%5BTrezor%20One%5D%20Trezor%20One%20Hardware%20Wallet?unique=539c3a4)