From the meteoric rise of Bitcoin’s (BTC) and Ethereum’s value (ETH), to notable merchants such as PayPal accepting BTC as a form of payment, cryptocurrency stands to become increasingly relevant in everyday life.

The cryptocurrency wave is so big that regulators are actually looking to dampen the deluge of interest — Joe Biden, the newest US president, plans to (almost) double the rate of capital gains tax for investment income.

But before you jump on that crypto bandwagon, you probably have some burning questions about it. Let’s get you some answers.

1. How volatile is cryptocurrency — and why?

On 14 April 2021, Bitcoin (BTC) hit a record high of ~US$64,895 (S$86,480).

But just a week later, as President Joe Biden announced his planned tax reform changes on 23 April 2021, the price of BTC dropped to under ~US$50,000 (S$66,630).

This should give you an indication of how volatile cryptocurrency is… and why.

Cryptocurrency’s volatility mostly has to do with:

- Lack of regulatory framework to accommodate its growth

- Lack of a physical form to ground its value

- Lack of market share compared to established goods such as gold or cash

Therefore, any sort of news, announcements or publicity related to any of these above mentioned factors have a large influence on a cryptocurrency’s value.

For example, the European Investment Bank (EIB), announced that they planned to launch a digital bond sale on the Ethereum blockchain network. Consequently, its cryptocurrency, ETH, which is also the second largest cryptocurrency by market cap, rose in value to above US$3,000.

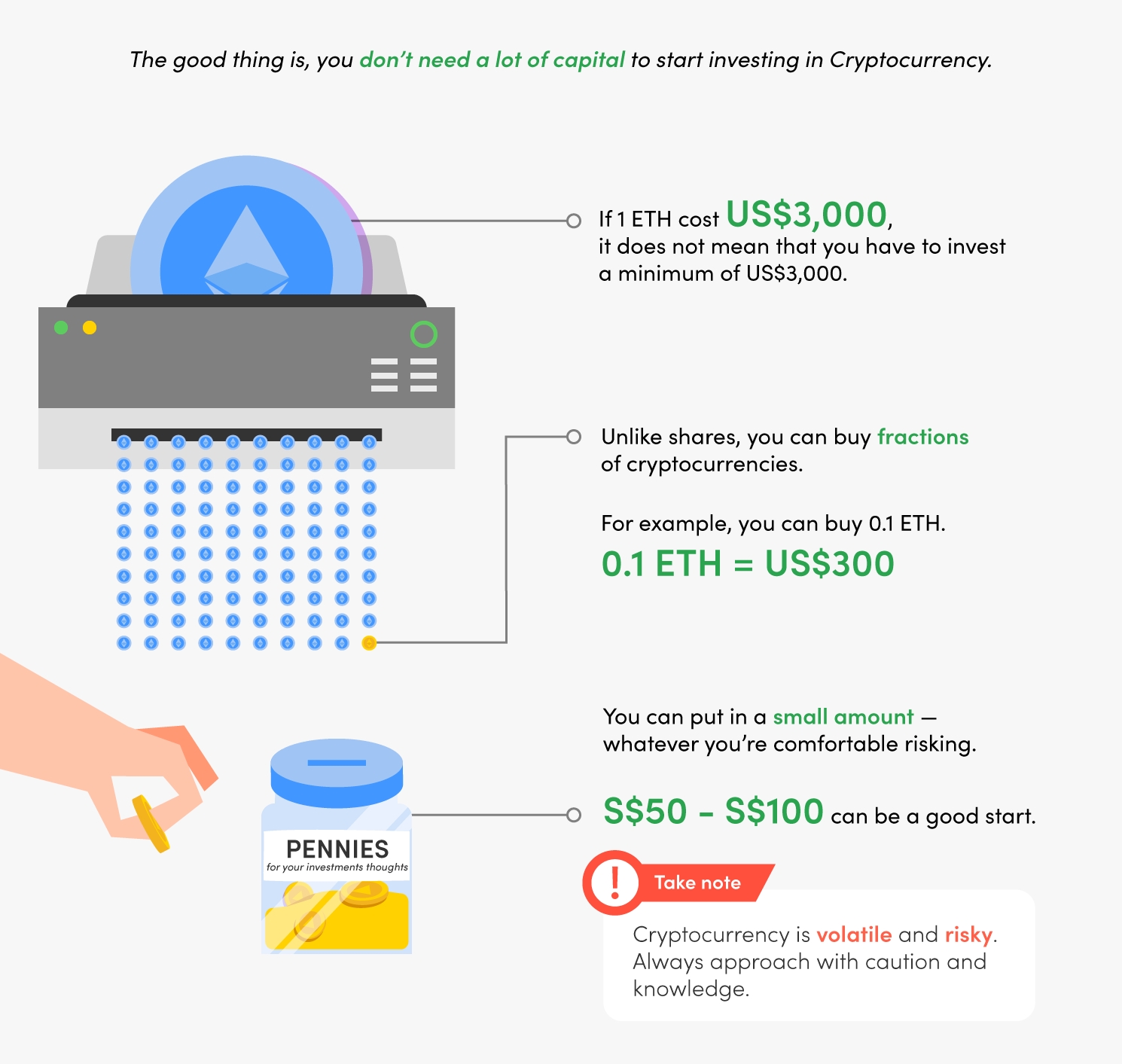

2. How much money do you need to buy crypto?

So if 1 BTC is currently going for about ~US$57,870 (S$77,000), does that mean you need to fork out S$77,000 to buy it?

Nope. Unlike, say, shares, you can buy fractions of cryptocurrencies — even if it’s, say, S$50 or S$100.

Another example of a really expensive crypto is ETH, or Ethereum. 1 ETH goes for around US$3,000 (S$4,096), and its value is increasing at a higher rate than BTC in the past year. This is due to Ethereum’s efficiency, scalability and applicability as a programming language.

But if you’d like to get in on ETH, you don’t need a large sum of money. You can put in a small amount — whatever you’re comfortable risking.

3. Which are the top cryptocurrencies out there?

Here are 10 of the biggest cryptocurrencies by market cap on 3 May 2021, according to CoinMarketCap. Market cap refers to the market value of the crypto in total — i.e. how much money people have already put in it.

| Cryptocurrency | Price | Market Cap | Circulating Supply | Supply Cap |

| Bitcoin (BTC) | ~US$57,955 | US$1.08 trillion | 18.7 million | 21 million |

| Ethereum (ETH) | ~US$3,100 | US$357.5 million | 115.7 million | 18 million annually, maximum amount uncapped |

| Binance Coin (BNB) | ~US$630 | US$96.2 billion | 153.4 million | 170.5 million |

| Ripple (XRP) | ~US$1.61 | US$73.4 billion | 45.4 billion | 100 billion |

| Tether (USDT) | ~US$1 | US$52 billion | 53 billion | Uncapped |

| Dogecoin (DOGE) | ~US$0.38 | US$49 billion | 129 billion | Uncapped |

| Cardano (ADA) | ~US$1.34 | US$42 billion | 31 billion | 45 billion |

| Polkadot (DOT) | ~US$37.60 | US$35 billion | 934 million | Uncapped |

| Uniswap (UNI) | ~US$44.13 | US$23.3 billion | 523 million | 1 billion |

| Bitcoin Cash (BCH) | ~US$1001 | US$18 billion | 18.7 million | 21 million |

Do note that these values represent a snapshot in time, and that a cryptocurrency’s price, market cap and supply can wildly fluctuate due to its volatility.

It’s important to note that, apart from market cap, the value of a cryptocurrency also depends on its circulating supply and supply cap.

Every cryptocurrency has a cap on how much cryptocurrency can be produced (mined). The smaller the gap between the supply and its cap, the scarcer it is. This drives prices up.

4. Where can you buy cryptocurrency in Singapore?

Unless you’re part of a mining farm, or have set up your own mining rig (hello, computer graphics cards global shortage) — you will most likely get your cryptocurrency through a crypto exchange platform.

A thing to note is that most of these exchange platforms transact in limited currencies. Not all accept SGD.

Most of the time, you can easily buy BTC or ETH (the two biggest cryptos) in Singapore dollars. But many of the smaller cryptocurrencies (or altcoins) only accept transactions made in USD or BTC.

Some of the best cryptocurrency exchanges in Singapore are Binance Singapore, Gemini, Kraken and others. We’re currently compiling a list of 10 crypto exchanges in Singapore, their trading fees, as well as their buying fees, so keep a lookout!

Also, note that to set up a crypto exchange account in Singapore, you’ll most likely have to go through a middleman like Xfers. Xfers facilitates the cash-to-crypto transaction via bank transfer.

Finally, it’s best to fund your crypto purchases using good old bank transfers. Paying by debit or credit card will incur additional fees of up to 3.75%. Not worth it.

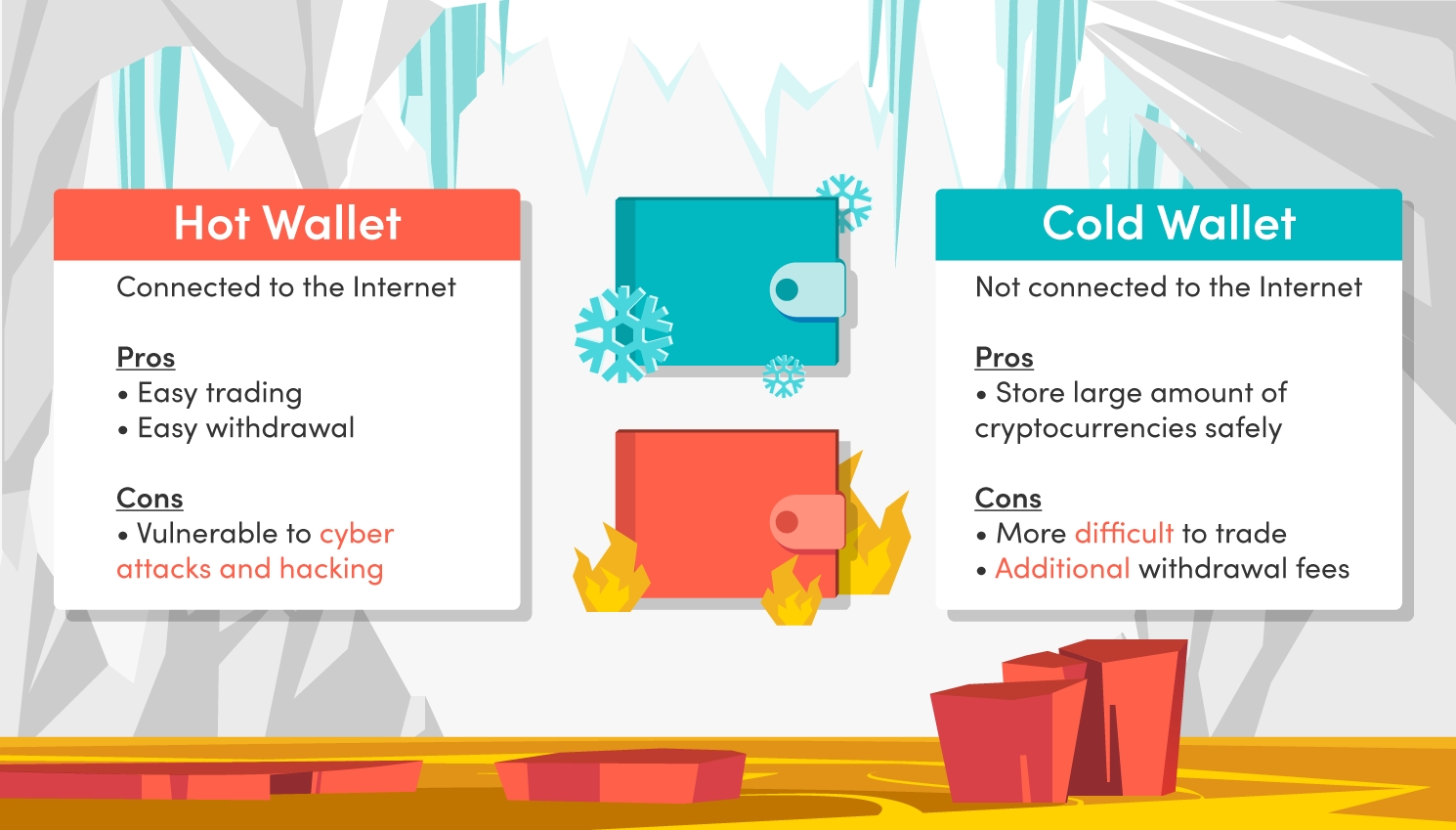

5. Hot vs cold wallet — how should you store your cryptocurrency?

There are two ways to store your cryptocurrency: in a hot wallet or a cold wallet.

Most crypto exchanges offer a hot wallet, i.e. a crypto wallet that’s connected to the internet. With a hot wallet, your cryptocurrencies can remain liquid, so as to facilitate easy trading and withdrawal.

The downside to having a hot wallet is that it’s vulnerable to cyber attacks and hacking, which is why a cold wallet could be a good option.

A cold wallet is a crypto wallet that is NOT connected to the internet.

There are different types of wallets, such as a USB flash drive, your desktop computer (that’s not connected to the internet, obviously) or even a corrosion-resistant steel card. These devices will store your private keys, seed phrases, wallet address and other information unique to your cryptocurrency.

It’s recommended for storing large amounts of cryptocurrencies, but it does make it a lot more difficult to trade it. Most crypto exchanges charge a withdrawal fee if you choose to draw your funds to store it in a cold wallet.

6. What else should you research before buying crypto?

The abovementioned points are just tips to get started on the act of buying cryptocurrencies, but now comes the thinking part — how do you decide on which crypto to buy?

Before you buy any crypto at all, we recommend reading the crypto’s whitepaper. Think of this as the crypto version of an annual report. It’ll help you assess a cryptocurrency by determining:

- What problems it aims to solve

- What their roadmap is going to be

- What role does their cryptocurrency play (i.e. for crypto exchanges or for transactions on their blockchain platform)

For example, Bitcoin’s whitepaper started out explaining its platform as a purely peer-to-peer electronic cash system with 100% transparency and zero interference from banks or other financial institutions.

Likewise, Ethereum’s whitepaper explained itself as a way to build on Bitcoin’s blockchain infrastructure by offering a way to create decentralised applications, such as exchanges, platforms and even entire ecosystems.

Meanwhile, Enjin Coin (ENJ) is meant for a different purpose entirely. It serves as the main mode of payment on Enjin’s blockchain gaming ecosystem, where users pay for games and non-fungible tokens (NFTs) and developers make games.

7. How much should you invest in cryptocurrency?

Cryptocurrencies as a whole, and consequently, blockchain technology, is still in a period of rapid growth.

This means that volatility is a given, and as such, should be approached with caution and knowledge. That volatility can deliver amazing returns, yet also result in prices plummeting with just a tweet.

In Singapore, the crypto market is still fairly unregulated compared to, say, stocks or insurance. There are precious few safeguards for the retail investor.

In fact, this is what Senior Minister Tharman Shanmugaratnam said about crypto in Parliament:

“Cryptocurrencies can be highly volatile, as their value is typically not related to any economic fundamentals. They are hence highly risky as investment products, and certainly not suitable for retail investors.”

So if you’re looking to start buying crypto, we recommend starting with an amount you can afford to lose. You can start by buying bits of crypto with just S$50 or S$100.

Meanwhile, most of your other investments should be tied to physical, real-world objects, such as real estate or stocks.

![[Trezor One] Trezor One Hardware Wallet](/web/image/product.template/49132/image_512/%5BTrezor%20One%5D%20Trezor%20One%20Hardware%20Wallet?unique=539c3a4)